Financial constraints restrict people from achieving their dreams and desires. A personal loan can help them get closer to those financial goals in the sense that the loan amount they need should be in sync with their income and within their ability to repay it.

A personal loan can help pay school or college fees, cover wedding expenses, and plan a surprise holiday, among many other things. Many people may confuse instant loans with personal loans, as these are now available instantly as long as you meet the requirements.

You can use instant loan apps to get a personal loan for enhanced convenience and quicker processing. These personal loan apps provide easy finance to customers at lower interest rates and simple documentation.

The financial market is full of mobile application options for people who want to avail of a Personal loan. Carefully understand that not all instant loan apps are the same.

Here are the top 10 personal loan apps to choose from:

Top 10 Personal Loan Apps in India

A personal loan app is available on the mobile app store of your smartphone. Download the app and apply for a personal loan instantly, spending little time and facing minimal fuss.

Choose from any of the apps below:

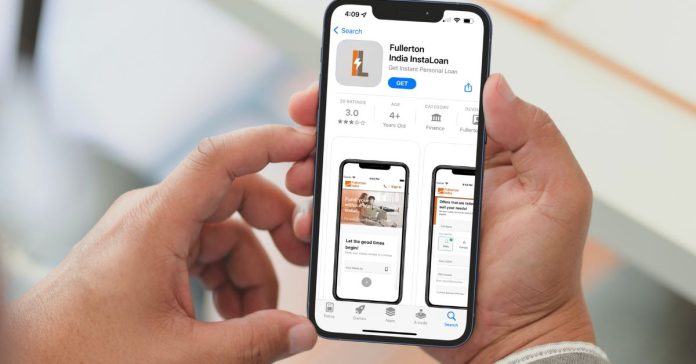

1. Fullerton India Instaloan App: The Fullerton India Instaloan App is the official mobile application of Fullerton India, one of India’s most trusted names in personal finance. The Fullerton India Instaloan App is designed categorically for salaried professionals, considering their requirements.

- A loan applicant can choose a loan amount ranging from Rs.50,000 to Rs.25 lakh, depending on the individual’s financial needs, income, existing obligations, and repayment capacity.

- Fullerton India charges the most reasonable personal loan interest rates, starting at as low as 11.99% per annum.

- The loan processing fee on such loans is transparent and low. It may range from 0 to 6 percent of the loan amount.

- Fullerton India offers a flexible tenure between 12 to 60 months for loan seekers to avoid the stress of loan repayment.

- The documentation required for a Fullerton India Personal loan is easy to meet, unlike loans offered by other lenders. A loan applicant has to submit only his PAN (Permanent Account Number) card, valid address proof, proof of employment, salary slips (previous three months), and bank statements (previous six months).

2. Buddy Loan: Buddy loan is another personal loan app where one can apply for a personal loan without waiting endlessly.

- The app offers personal loans between Rs.10,000 to Rs.15,00,000 to eligible customers.

- The app is known for its quick response to personal loan applications.

- The app offers a doorstep collection of documents from loan applicants.

3. NAVI: The NAVI app offers personal loans to loan seekers through a 100% digital and paperless process.

- Zero processing fees on instant personal loans.

- Customers can avail of a loan of up to Rs.20 lakhs for up to 6 years.

- Eligible customers can submit their PAN card and Aadhar card details and get an instant loan in less than 10 minutes using the NAVI app.

4. PaySense: A borrower not wanting to undergo the process of scanning and sending the documents for a personal loan and use the PaySense app.

- Get a personal loan between Rs. 5000 and Rs.5 lakhs on this app.

- With relevant documents, first-time loan seekers with no credit history can also get a personal loan on the PaySense app.

5. Money Tap: The Money Tap app is renowned for quick loan approvals and disbursements.

- Get an instant loan between Rs. 3000 and Rs. 5 lakh by downloading the Money Tap app.

- Customers can get their personal loan approved in as less as 4 minutes using the Money Tap app.

- The loan duration is between 2 to 36 months.

6. Dhani: The Dhani app is especially popular among students working part-time to meet their expenses.

- The app provides personal loans between Rs. 1000 and Rs. 5,00,000.

- The app has a prompt customer support service and offers unlimited access to doctors.

7. Nira: The Nira app offers personal loans to customers through a simple registration process.

- The app offers personal loans between Rs. 3000 and Rs. 5,00,000.

- The app does not require the borrower’s credit score to provide a personal loan.

- Pay interest only on the money utilised.

8. Home Credit: The app offers personal loans to students who are not earning yet and senior citizen pensioners with a basic monthly income.

- Personal loan of up to Rs. 2 lakhs to eligible customers.

- The loan duration can extend for up to 26 months.

9. Payme India: Loan seekers can use this platform to get personal and corporate loans if they run a business.

- Loans between Rs. 1000 and Rs. 1,00,000 are available to eligible customers.

- Personals loans can get approved within a day if the customer’s documents are complete.

10. India Lends: The app offers customers loans and credit cards under various categories.

- Loan between Rs. 15,000 to Rs. 50,00,000 to eligible customers.

- Easy approvals and quick loan disbursal process.

Among the several personal loan apps available to customers, the Fullerton India Instaloan App offers some unique features to loan seekers, like easy documentation, instant loan approval, transparent loan processing, and much more