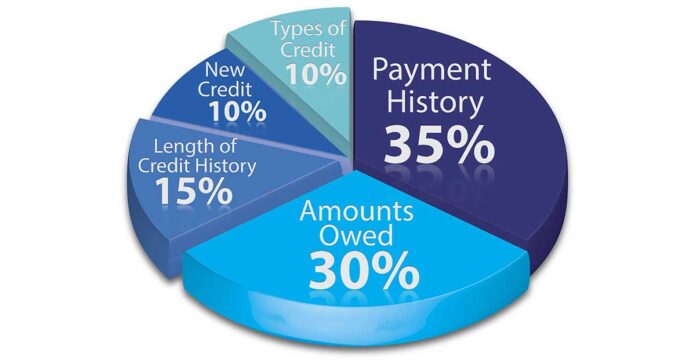

Factors that are considered during credit score calculation include payment history, credit utilisation, credit age, and credit type. In this piece, we’ll break down each of these factors and discuss how much of an impact they have on your credit score.

Overall Accounts – Low Impact

Having a good balance between secured and unsecured credit is a sign of a solid financial history. Unsecured forms of credit include credit cards, whereas secured forms include car loans and mortgages. When you use several kinds of credit, it helps your score.

Although its impact is small in the grand scheme of things, it is not to be disregarded. The total amount you owe on both types of credit is an indication of how well you manage them. Your credit score may take a hit if you borrow a large sum of money from a single lender.

Besides the duration of your credit history, the ratio of how much of your available credit you are really using has the greatest impact on your credit score. The ratio of one’s used credit to their available credit is known as the credit utilisation ratio. The credit utilisation ratio is calculated by dividing the current balance by the total amount of available credit. Experts advise keeping your credit utilisation between 30-40% at all times.

Impact of Credit on Age: Moderate

Your credit history is included in your score to give a fuller picture of your creditworthiness. If you have a good track record of handling credit responsibly and making payments on time across all of your open credit accounts, your credit score will grow. Lenders consider the duration of your credit history when making a decision about whether or not to issue credit to you. This is why it’s better to keep an old credit card account open than to open a new one.

An Indicator of Financial Responsibility

Payment History This section of your credit report contains some of the most important information in determining your credit score. Your consistent payment history for bills and loans demonstrates your responsible borrowing practices and low default risk. A reduced interest rate and a quicker approval time are the results of a solid credit history. One’s credit score can take a serious hit in the event of late payments, missed payments, etc.

In addition to the types of accounts, credit inquiries (hard inquiries) are also factored in. A person should always verify their credit score on their own before asking for a loan. On Bajaj Finserv, you can get a free credit report.

In what ways may one improve their credit rating?

To what extent various measures can improve your credit score depends on your unique credit history. Some things to remember, however, can help nearly anyone improve their credit rating:

Check the accuracy of your credit reports

Checking your credit reports at the three major consumer reporting agencies is a great starting step in repairing your credit. After verifying that there are no errors or red flags for identity theft and fraud, check to see if you have any past-due amounts or accounts that have gone into collections. The first order of business in dealing with this unfavourable information is to settle all outstanding obligations.

Don’t let your payments get behind

One of the easiest strategies to improve your credit score is to pay off your debts on schedule and in full. Payment history accounts for a significant portion of credit scores, thus timely payments are crucial. Automatic payments can be set up for your accounts, and notifications can be set up to remind you if you tend to forget about payments.

Don’t overspend and risk losing access to more borrowing

Keep your credit utilisation ratio below 30% as a general rule. If lowering your utilisation percentage through spending cuts alone isn’t enough, you can also try asking for an increase in your credit limit.

Restricting who can open new accounts is essential

Whenever you apply for new credit, lenders will research your credit history (a practice known as a “hard inquiry”). Applying for credit less frequently will help your score. Opening a new line of credit can help you improve your credit score by decreasing the average age of your credit history.

After credit score calculation if the range for a credit score is 300 to 900, with the average being around 650, is considered good. This figure is established by credit reporting organisations in each nation.

Most financial organisations (such as banks and NBFCs) will consider your credit to be outstanding if it is 750 or higher. Each credit bureau uses its own methodology to arrive at its final credit score.

Apart from this, if you waant to know about Buy Non-Prime accounts at the lowest price then please visit our Finance category